It is very hard for many people to understand the concepts behind a trust. The concept has a long history and development, and some of those legal concepts can be confusing. It can be especially difficult when the trustee of the trust is a company.

What is a trust?

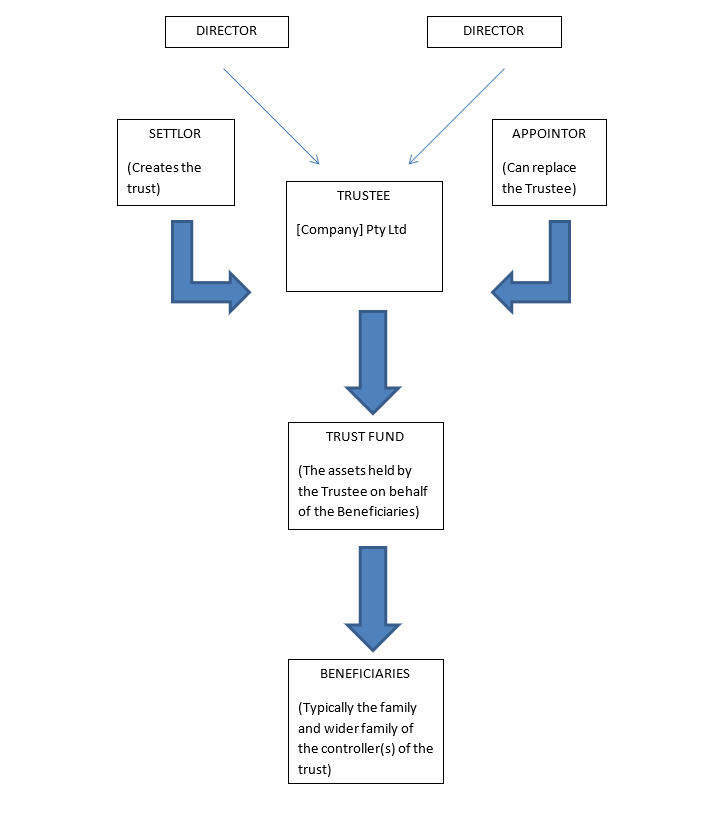

Essentially, a trust is an arrangement where one person holds assets on behalf of, and for the benefit of, others. The person who controls the asset is known as the trustee and the person who benefits is a beneficiary. Typically, the creator of the trust sets out specific terms regarding how the assets are to be managed in a document called a trust deed.

How is a trust set up?

A discretionary trust is established by an independent person (Settlor) who makes a gift of a sum of money (Settled Sum) to a person(s) or company (Trustee) for the benefit of specified persons (Beneficiaries) by signing a Trust Deed which sets out the conditions on which the Trustee must hold that money and any further money which is added to the trust.

What can the trustee do with the trust fund and what is “discretionary”?

The Trustee must hold the trust fund for the benefit of the Beneficiaries. The Trustee can also acquire other assets for the benefit of the Beneficiaries and, subject to the powers given to the Trustee in the Trust Deed may be able to borrow money, to invest, either in income producing assets like a business or more passive assets which increase in value over time such as shares or property. Income earned by the trust fund forms part of the trust and is for the benefit of the Beneficiaries.

The Trustee can distribute part or all of the income to the Beneficiaries. It can be retained or paid to Beneficiaries, or paid to some Beneficiaries unequally, or not at all. This is the reason for the term “discretionary” – the Trustee can use their discretion to decide how the income is dealt with. Furthermore, whilst the trust must “vest” ie be given to the Beneficiaries, 80 years from the date of commencement of the trust, the Trustee also has the discretion to distribute part of the trust fund to the some or all of the beneficiaries, or to vest the trust early by distributing all of the assets of the fund and winding it up.

Why would you want a discretionary trust?

You may choose to set up a trust for different reasons but commonly, a discretionary trust could assist with the following:

- Income Tax – As the trustee has discretion to allocate income to beneficiaries as they see fit, it may be possible to distribute income to a family member who has a lower marginal rate of income tax For example, a spouse on a lower marginal rate or perhaps a uni student or apprentice who needs financial assistance can have distributions made to them at a lower tax rate.

- Capital Gains Tax – Individuals and trusts are allowed a 50% exemption on the capital gain on assets which are disposed provided they have been owned for at least 12 months. Companies must pay capital gains tax on the full amount of the gain. Accordingly, for appreciating assets, ownership through a trust is generally beneficial.

- Asset protection – Generally speaking assets held by a trustee of a discretionary trust cannot be taken by a creditor unless the debt is a debt of the trust. For example, the trustee’s dog accidentally knocks a passer-by off their bicycle causing them injury. The assets of the trust are not able to be attacked by the cyclist who is claiming damages for their injuries. Similarly, where a creditor is chasing a beneficiary, unless the trustee exercises their discretion to make a distribution, the assets of the trust cannot be taken by the creditor.

- Estate Planning – a discretionary trust set up in a Will could be used to protect the assets of the estate eg a parent where their child is a bankrupt. Rather than the trustee in bankruptcy taking the whole of that child’s inheritance, the trustee may not distribute assets of the trust until after the beneficiary has been discharged from bankruptcy.

[This is not an attempt to give tax advice. You should consult your accountant to seek specific advice on your circumstances before making any decisions relating to your tax objectives and requirements.]

Are there any disadvantages?

- Whilst the set-up costs of a trust are generally fairly reasonable, there will be ongoing administrative expenses, particularly in relation to maintaining proper accounts and lodging tax returns.

- Unlike a company structure, profits should not generally be retained in the trust as this would likely cause adverse tax outcomes. As they must be distributed, the profits will end up being taxed in the hands of one beneficiary or another.

What does it mean when I have a corporate trustee?

Like a person, a company is a legal entity. However, in the case of a company, its directors meet to resolve to act and these board meetings act as the “mind” of the company. Sometimes, directors are less formal about these decisions but they should still be recorded in writing as resolutions.

If a trust has a company as trustee, this might look like an extra layer in the control of the trust. The trust assets are controlled by the company which in turn is controlled by its director(s). One reason why you might consider a corporate trustee is because companies don’t die – even if a director dies, new directors can be appointed and the trustee continues to own the assets on behalf of the trust and a replacement of trustee is not required.

What is an appointor?

If the trust deed created the position of Appointor, their role is to control the position of Trustee. The Appointor cannot make decisions regarding trust assets but they usually have the power to remove and replace the trustee as they see fit. This means that the Appointor has ultimate but indirect control as they can replace a trustee who makes decisions which the Appointor does not agree with.

What’s the point?

Discretionary trusts are set up to allow the people controlling it to choose who can benefit from the trust and how much beneficiaries can receive at any time. They can provide beneficial tax outcomes and they can be structured to provide control and protection.

Here’s a diagram which may assist…